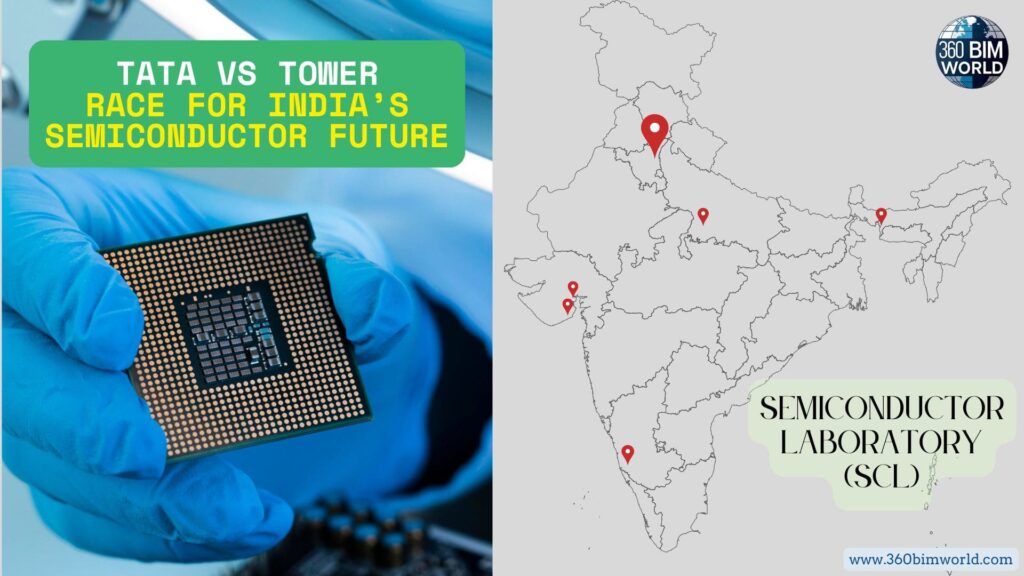

Tata vs. Tower: The High-Stakes Race for India’s Semiconductor Future

India’s quest to become a global semiconductor manufacturing hub is entering a critical new phase. All eyes are on the Semiconductor Laboratory (SCL) in Mohali, Punjab, as the government moves to a decision on a landmark ₹4,000 crore project to modernize the decades-old chip facility. The competition has come down to two formidable players: Tata Semiconductor from India and Tower Semiconductor from Israel.

This isn’t just a routine upgrade; it’s a strategic move to secure India’s supply chain for essential mature-node chips, which are the workhorses of everything from defense systems to electric vehicles.

The Importance of the SCL Mohali Project

Established in 1983, the SCL Mohali facility has long been vital to India’s strategic sectors, including space and defense. However, its current 180nm fabrication technology is a relic in a world of 3nm chips. The government’s modernization plan aims to elevate the facility to produce more advanced chips at the 65nm or even 40nm nodes.

This upgrade is crucial for several reasons:

- National Security: It reduces reliance on foreign suppliers for critical defense and space-grade components.

- Economic Resilience: It builds an indigenous capacity to produce chips for the automotive, telecom, and industrial sectors, bolstering the “Made in India” initiative.

- Talent Development: The modernized Mohali chip lab will serve as a training ground for India’s next generation of semiconductor engineers and researchers.

Meet the Final Contenders: Tata vs. Tower

Both companies bring unique strengths to the table, and their selection will shape the trajectory of India’s semiconductor journey.

Tata Semiconductor: The Domestic Champion

Part of the vast Tata Group, Tata Semiconductor represents India’s homegrown ambition. The company is already a significant investor in the country’s chip future, with a massive ₹91,000 crore semiconductor fab planned for Dholera, Gujarat. Its deep financial resources and extensive ecosystem make it a strong contender. A win for Tata would be a powerful statement about India’s capacity for self-reliance in this critical technology.

Tower Semiconductor: The Global Veteran

With a proven track record of operating fabrication plants in the U.S., Japan, and Israel, Tower Semiconductor offers unparalleled global experience. The company is a leader in producing the exact type of analog and mixed-signal chips that are a focus of the SCL project. Its expertise could enable a faster, more efficient upgrade, bringing world-class technology and best practices to India.

What’s Next

Sources indicate that both Tata and Tower have successfully cleared the technical evaluation stage and are now undergoing financial bidding. While no official winner has been announced, the final decision is expected soon. The selected company will be responsible not only for upgrading existing machinery but also for expanding capacity and providing long-term support for the facility.

Regardless of who wins the contract, one thing is clear: the modernization of SCL Mohali is a landmark project that reinforces India’s commitment to building a robust and resilient semiconductor ecosystem.

Top Questions About India’s Semiconductor Mission

Why is India modernizing an old chip plant instead of just building a new one? The SCL Mohali facility is being modernized because it is a strategic asset with existing infrastructure and a long history of serving critical national needs. The upgrade is faster and more cost-effective than building a new plant from scratch, allowing India to quickly begin producing mature-node chips essential for its strategic sectors.

What are “mature-node” chips, and why are they so important? Mature-node chips are manufactured using older, well-established technology (e.g., 65nm to 180nm). While they are not used in advanced smartphones, they are vital for a vast range of applications, including automotive electronics, power management, industrial machinery, and defense systems. Securing their supply is crucial for a country’s economic and national security.

What is the India Semiconductor Mission? The India Semiconductor Mission is a government-led initiative with a ₹76,000 crore (approx. $10 billion) incentive plan to attract investments and build a complete semiconductor ecosystem within the country, covering everything from design and manufacturing to assembly and testing.

Is Tower Semiconductor a new player in India? No, Tower Semiconductor has been a technology partner to SCL Mohali for its existing 180nm process. It has also been in discussions to set up a larger commercial fab in India, demonstrating its long-standing interest in the Indian market.

What is the difference between SCL Mohali’s chips and those in my phone? The SCL Mohali facility currently produces chips at the 180nm node, while the chips in modern smartphones are made with much more advanced technology, such as 3nm or 5nm. This difference in node size determines the chip’s performance and power efficiency.

What is the current status of the SCL Mohali modernization project? As of the latest updates, the project is in the financial bidding stage. Tata Semiconductor and Tower Semiconductor have been shortlisted after a technical evaluation, and a final decision on the winner is expected to be announced soon.

Will India build more semiconductor fabs in the future? Yes. In addition to the SCL Mohali modernization, the government has already approved multiple proposals for new semiconductor projects, including a large-scale fab by the Tata Group in Gujarat and a collaboration between CG Power and Renesas in Sanand. India is actively pursuing several projects to grow its semiconductor ecosystem.

Leave a Reply to Amaravati: The Phoenix City Rising – Andhra Pradesh's Capital Reborn in 2025 Cancel reply